crypto tax calculator canada

2022 Federal Tax Brackets and Rates. 12 tax on winnings above 500.

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

Estimate your provincial taxes with our free Québec income tax calculator.

. Top crypto platforms in Canada. Renovations of up to 10000 20000 starting with. Please enter your income deductions gains dividends and taxes paid to.

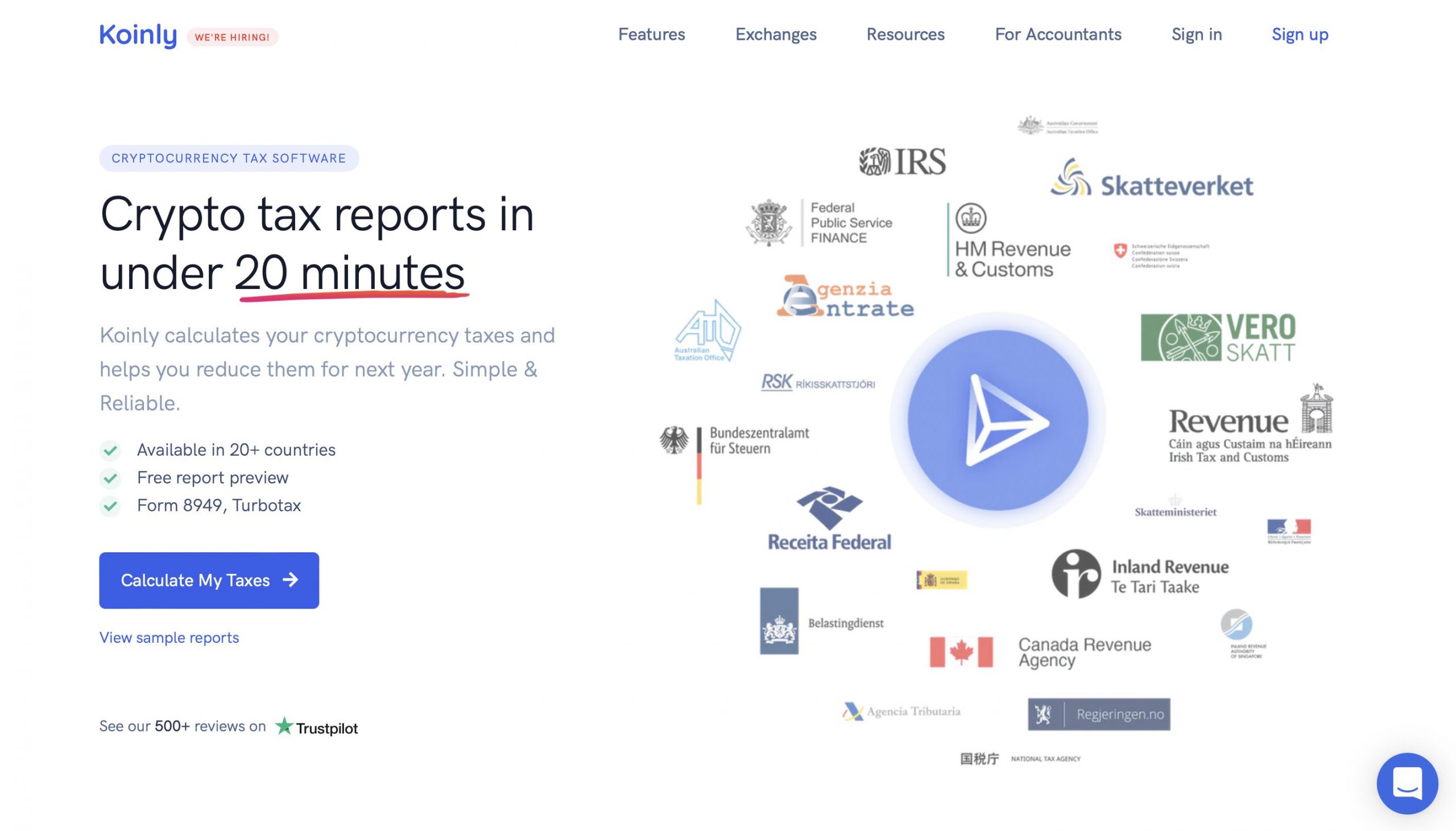

The recent raids on a crypto exchange and allegations of opaqueness around its shareholding and failure to do a KYC check is seen to be the latest blow to the efforts by market players. 65 countries like the US Canada Australia the UK Germany Norway Greece France Malta Poland Finland Sweden etc. For those living in the United Kingdom and Canada things are a little more complicated but a.

In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year. According to a Decrypt report citing sources the latest round of job cuts has not been announced publicly. Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains.

138 taxes on all. 15 on the first 50197 of taxable income and. Local retailer fees on winnings from 100 to 500.

Crypto Tax Free Countries 2022. CoinSmarts simple interface makes crypto trading accessible to beginners but the platform also offers tools and services for experienced traders. Koinlys crypto tax report includes End of Year Balances to clearly show you what your clients crypto holdings are at the end of their tax year.

You can claim the Canada Workers Benefit when you file your taxes electronically or by filling and submitting Schedule 6 Canada workers benefit if you file a paper tax return. Our content is designed to educate the 300000 crypto investors who use the CoinLedger platform. After-tax income is your total income net of.

10 tax on people who live 184 days a year in the country. The series of such testnet upgrades will lead to a successful final merge which is expected to drive the price momentum for Ethererum. 2022 free Canada income tax calculator to quickly estimate your provincial taxes.

Cryptocurrencys rise and appeal as an alternative payment method. As we approach the merge deadline Ethereum is expected to create a new support level at the 2000 mark and will lead the overall growth of the crypto market. See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed.

The federal tax rates in Canada follow the same pattern with rates increasing as your taxable income goes up. Crypto Tax Calculator CryptoTaxHQ August 3 2022. Tax-Loss Harvesting With A Crypto Tax Calculator.

For 2022 you pay. QPIP and EI premiums and the Canada employment amount. Crypto Tax Calculator performs tax calculations with a high degree of accuracy.

Whether you accept or pay with cryptocurrency invested in it are an experienced currency trader or you received a small amount as a gift its important to understand cryptocurrency tax implications. According to the report the Singapore-based company. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022.

Interest in cryptocurrency has grown tremendously in the last several years. There is a Federal Home Accessibility Tax Credit that was introduced in 2016 for those over age 65 or who qualify for the disability tax credit. It is one of the most accurate crypto tax software.

Cryptocurrency Tax Calculator. Top 10 crypto tax free countries2. View the value of their holdings along with their acquisition costs.

30 tax on people who live less than 184 days a year in the country. Brought to you by Koinly a cryptocurrency tax calculator portfolio tracker for traders. It enables you to generate tax reports for all financial years.

Though our articles are for informational purposes only they are written in accordance with the latest guidelines from tax agencies around the world and reviewed by certified tax professionals before publication. Learn all about the best crypto tax free countries to live in in 2022. 26 on the next 55233 of taxable income on the portion of taxable income over 100392 up to 155625 and.

To claim the Canada Workers Benefit you have to be a Canadian resident for income tax purposes and older than 19 years of age by December 31 of the applicable tax year. Being audit-proof means having every crypto asset accounted for.

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

11 Best Crypto Tax Calculators To Check Out

Cryptocurrency Taxation In Canada In 2022 Cryptocurrency Capital Assets Goods And Services

Crypto Tax Calculator Review August 2022 Finder Com

Github Davidosborn Crypto Tax Calculator A Tool To Calculate The Capital Gains Of Cryptocurrency Assets For Canadian Taxes

How To Calculate Crypto Taxes Koinly

Cryptocurrency Tax Guides Help Koinly

11 Best Crypto Tax Calculators To Check Out

Crypto Tax Calculator Review August 2022 Finder Com

Investment Tracker At A Glance With Cryptocurrencies Nfts Etsy Canada In 2022 Investing Investing For Retirement Google Sheets

11 Best Crypto Tax Calculators To Check Out

11 Best Crypto Tax Calculators To Check Out

11 Best Crypto Tax Calculators To Check Out

Calculate Your Crypto Taxes With Ease Koinly

Cryptocurrency Tax Calculator Forbes Advisor

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income